Mission: To Educate & Protect the Policyholder

Policy Review: An insurance policy is often purchased to protect the lender as a requirement when a home is bought. A business insurance policy is bought in order to protect and maintain the financial health of the business. When was the last time you read to see what is actually covered in these policies? Waiting for the time you need it is too late. Educating the policy holder with a policy review is important. We conduct policy reviews so when a claim occurs owners’ have information needed for the claims process to go smoothly as possible.

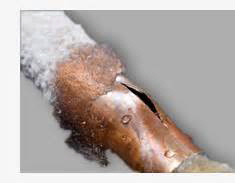

Perils occur suddenly and accidentally. When you experience a loss covered by your Property Insurance Policy, its your primary obligation to report the loss and your duty prove your loss. Owners need to make the damaged property available for inspection by the company. What is said and what you may do impacts how your claim will be handled by the insurance company and will effect how you will be paid.

Educating the policy holder with a policy review is an important part of the public adjuster's role as the property owner's advocate. The policy review brings an awareness to what a policy actuality covers.

The insurance policy terms require the owner prove their loss. It is the owner's responsibility. Public adjusters assist owner's meeting this requirement assuring the owner's interest are being addressed.

Metro Public Adjustment has a staff of structural engineers and other experts to manage a claim for payment that enables the owner to restore property to its prior state. Insurance company adjusters work for the insurance company. Jay Fienman, author of “Delay, Deny, Defend”, points out that “The company delays payment of a claim, denies all or part of a valid claim, or aggressively defends...” the insurance company's non payment to policyholder of what they are rightfully owed. Public adjusters work for the policy holder adjusting owners damage claims.

The Insurance company knows that the home owners do not have the knowledge required to prepare valuations for a claim. This is why using a licensed public adjuster has become more important today.

CLICK THE VIDEO LINK BELOW FROM PBS.

“When insurance doesn't work, the consequences are more severe than when any other kind of company fails to keep its promise. If the insurance company refuses to pay a claim, it is too late to go elsewhere for another policy; no company will write a policy tol pay for fire damage that had already occurred after a fire.” states Fienman

To learn whats in your policy call 1-800-2510746 for an appointment..

Educational Report: 60 Minutes On Insurance Company Fraud.

Reasons To Use a Metro Public Adjuster.

- Maximum Settlement

- Policy review and explanation

- Computer claim tracking

- License and Bonded

- Reputation (17 years in business )

- On going training

- Full Company Staff & Legal Support

- Industry Standard Estimate System (xactimate)

- Metro’s BBB (A+) rating

- Temporary housing

- Fire & Smoke Expertise

- Customer Service

- Protect Homeowners Rights

- Adjuster support staff

- Proper claim presentation (1st 10 mins are critical)

- Identify future issues

- Provide certified estimate

- Claim presentation support

- Provide emergency service support

- Cutting Edge of Industry knowledge

- Industry relationship.

- Resources of the Largest Public Adjustment Firm

|

Property Inspections and what are you against when submitting a claim by yourself. Company adjusters minimize your damage by encouraging cost savings methods.

Real Estate Professional - Add a New Tool to Your Tool Box!

|

||

|

|

||

Preserve & protect property's value. Dot Nicklus, Broker, Public Adjuster 1-800-251-0746 19 Willard St,. Garfield, NJ